Online Banking

PayrollPanda generates batch payment files for certain banks so you can conveniently submit and pay contributions to the statutory bodies. For more information, please visit How to generate payroll files for your bank?

If you submit and pay your EIS contributions via your bank portal, you do not need to submit again via the Assist Portal. Contributions will be automatically updated in your Assist Portal.

Perkeso Assist Portal

Click How to register with PERKESO Assist Portal? for more info on how to register for the Perkeso Assist Portal.

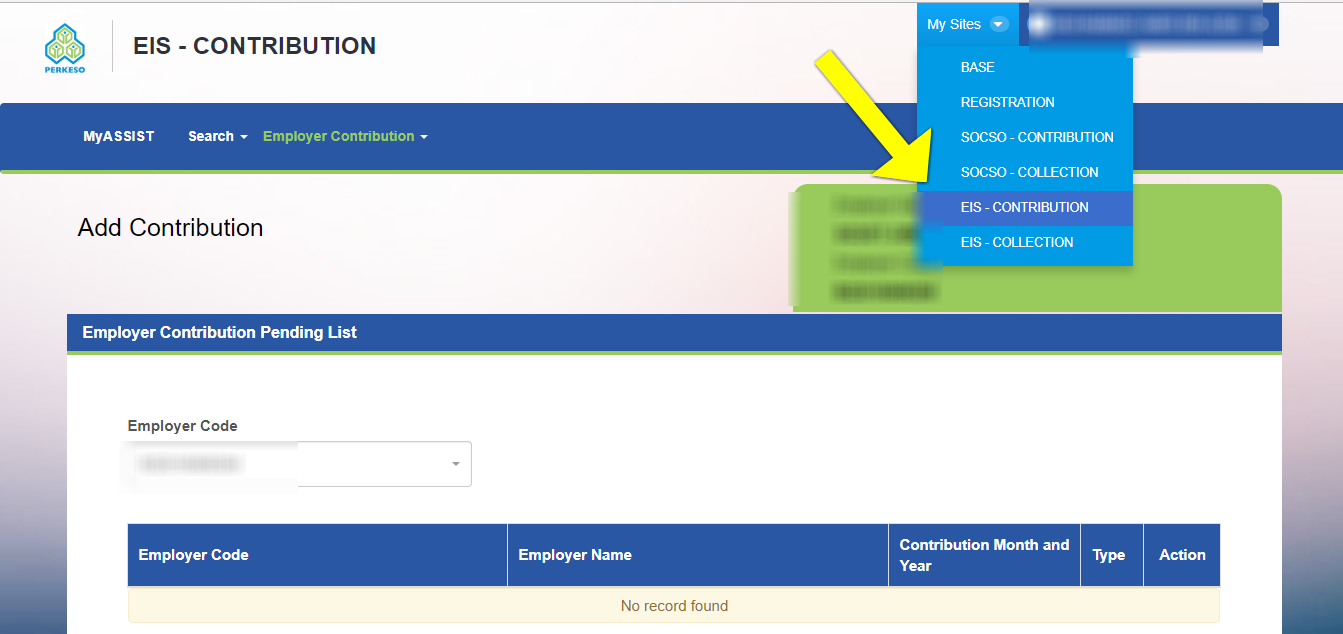

- Login to the Perkeso Assist Portal.

- Click on My Sites and choose EIS - Contribution to generate an ECR

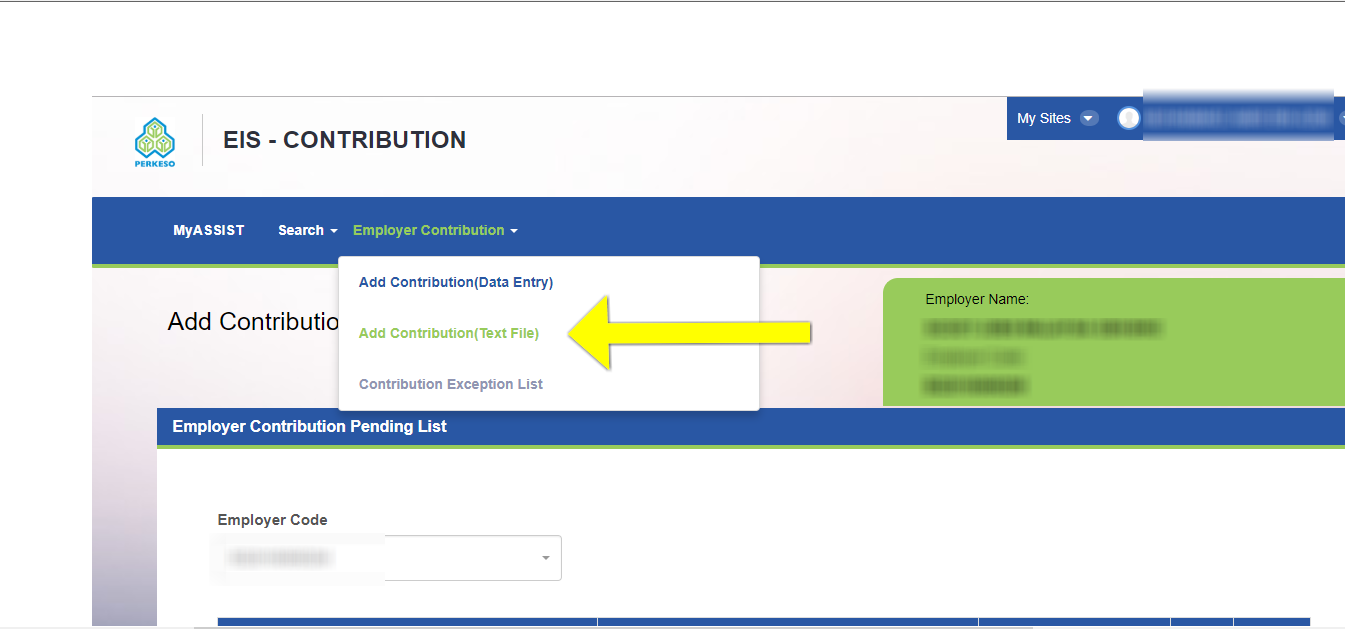

- Next click on Employer Contribution and choose Add Contribution (Text File)

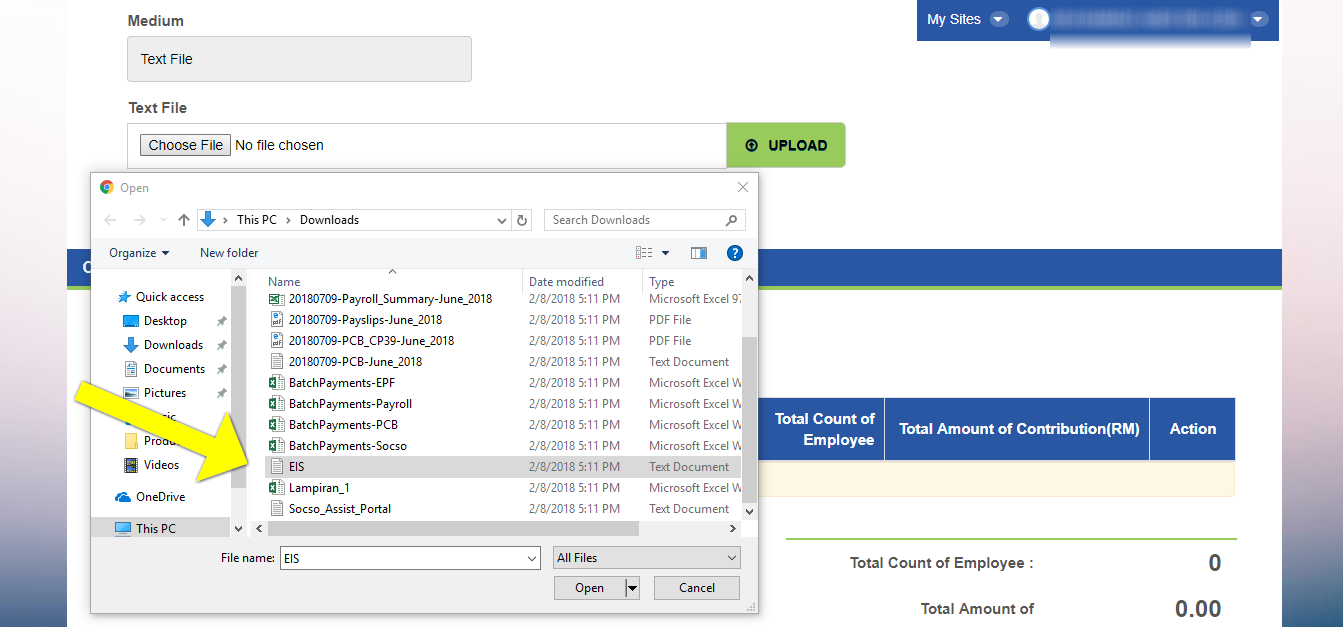

- Click on TEXT FILE, select the EIS.txt file and proceed with the upload. Note that PayrollPanda will generate the EIS.txt file upon completing your payroll.

- Once the file is uploaded Submit the file. You can opt to complete your payment via any of the below payment options.

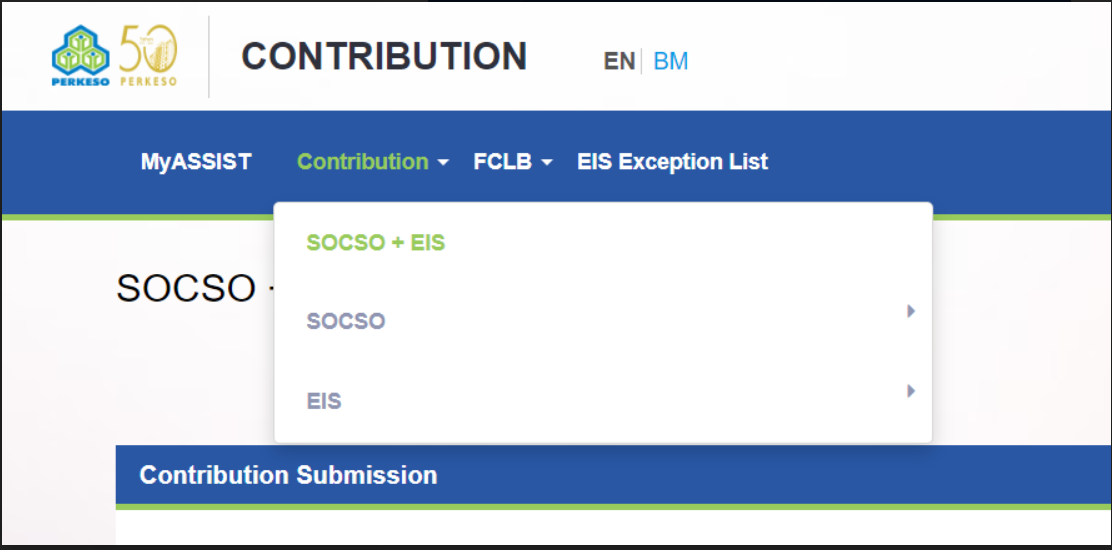

PayrollPanda also generates the SOCSO + EIS combined txt file introduced by PERKESO from July 2022. The file can be found in your payroll zip file downloaded after you submit your payroll, and is named according to the following format: SOCSO_EIS_082022.txt. The file can be uploaded in the Assist Portal under Contribution > SOCSO + EIS instead of uploading the separate SOCSO and EIS txt files.

For more detailed information on the Assist Portal, you can refer to the Assist Portal User Manual.

Payment Options for EIS

1. FPX Payment directly via the Perkeso Assist Portal

Note that for retail/private banking accounts (B2C), transactions can only be made for a minimum of RM1.00 up to a maximum of RM 30,000. For company/corporate banking accounts, minimum transactions needs to be RM 2.00 up to a maximum of RM 1,000,000. Transaction limits are subject to individual Internet Banking limits.

2. Electronic Funds Transfer (EFT)

Kindly contact Perkeso's Customer Service Hotline at 1-300-22-8000 or do send them an email at perkeso@perkeso.gov.my for further information.

3. Cheque, money order or postal order

You may submit a cheque, money order or postal order for the amount stated in the ECR. Please ensure that your cheque, money order or postal order is made payable to PERTUBUHAN KESELAMATAN SOSIAL or PERKESO and has the following details written on the back: Name, Employer Code, the month and year of contribution.

4. Payment via Bank Counter

Currently available at Maybank, RHB Bank and Public Bank.