Every employer, as well as every company regardless of whether they have employees or not, must submit form E to LHDN. Failure to do so will result in LHDN taking action against the company's directors. Employers are liable to a fine of not less than RM200 and not more than RM20,000 or to imprisonment for a term not exceeding 6 months or both. Form E must be submitted by 31 March of the following year, with an additional 1-month grace period for online filing.

For companies, form E submission can only be done online. Non-companies still have the option to submit via postal or hand delivery, in addition to e-filing.

How to submit Form E via e-Filing?

Step 1: Generate Form E and CP8D txt file via the PayrollPanda system

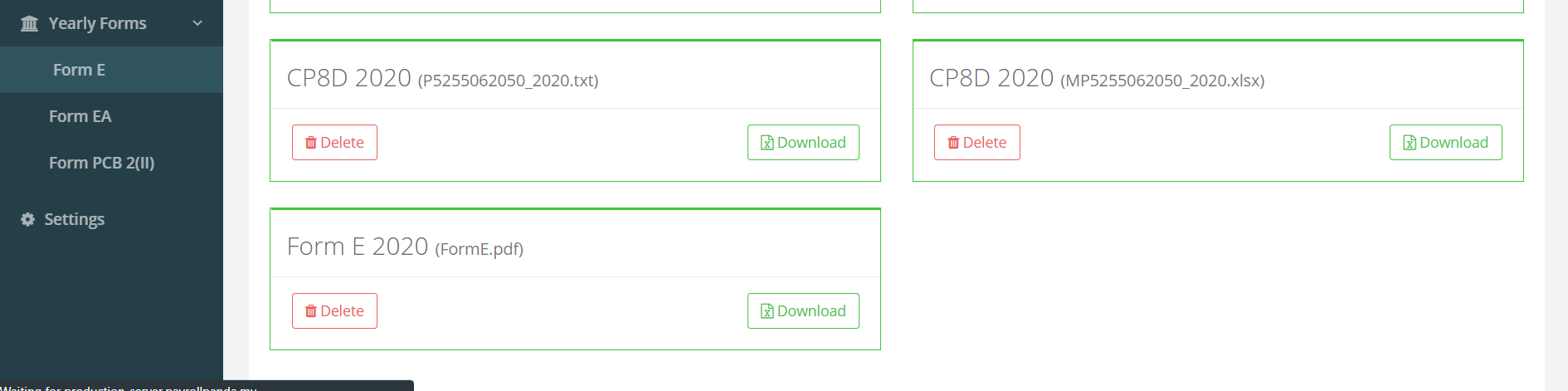

Login to PayrollPanda, go to Yearly Forms > Select Form E > Download the CP8D txt file and form E pdf file. Please be reminded to check the forms as it is the employer’s responsibility to provide accurate information to the statutory bodies. If you are filing the E form online, the pdf file is for your information only to help you fill the details in the online form. The CP8D txt file will need to be uploaded during online filing of the E form.

Step 2: Submit form E to LHDN via e-filing

Login to https://ez.hasil.gov.my/CI/ from 1 March. Please note that the website is available in English and Bahasa Melayu. You can find the language option at the top left and select the language you prefer. The Identification No. used to log in is the IC or passport number which you entered in your application form when registering with LHDN as an Employer.

This 2-minute video will take you through the process of filing form E online.

If you select the option to email the CP8D to LHDN during e-filing of your E form instead of uploading the txt file, you should download the excel version of the CP8D from our payroll software and email it to CP8D@hasil.gov.my.

Struggling with payroll? Let us help. Book a demo.