EPF submission and payment can be made either via e-Caruman or online banking. For payment via e-Caruman, you are required to have an account with KWSP i-Akaun. Meanwhile for online banking, you will need to upload the EPF payment bank file via your bank portal. For PayrollPanda users, files for both EPF submission methods can be obtained upon payroll submission.

How to submit/pay EPF via e-Caruman

Log in to KWSP i-Akaun to submit all employee contribution details online. Under the Contribution section, choose Submission of EPF Contribution (Form A). If the form is already submitted, you can choose Payment Only and proceed with payment.

Next, you are required to choose a form type for submission.

-

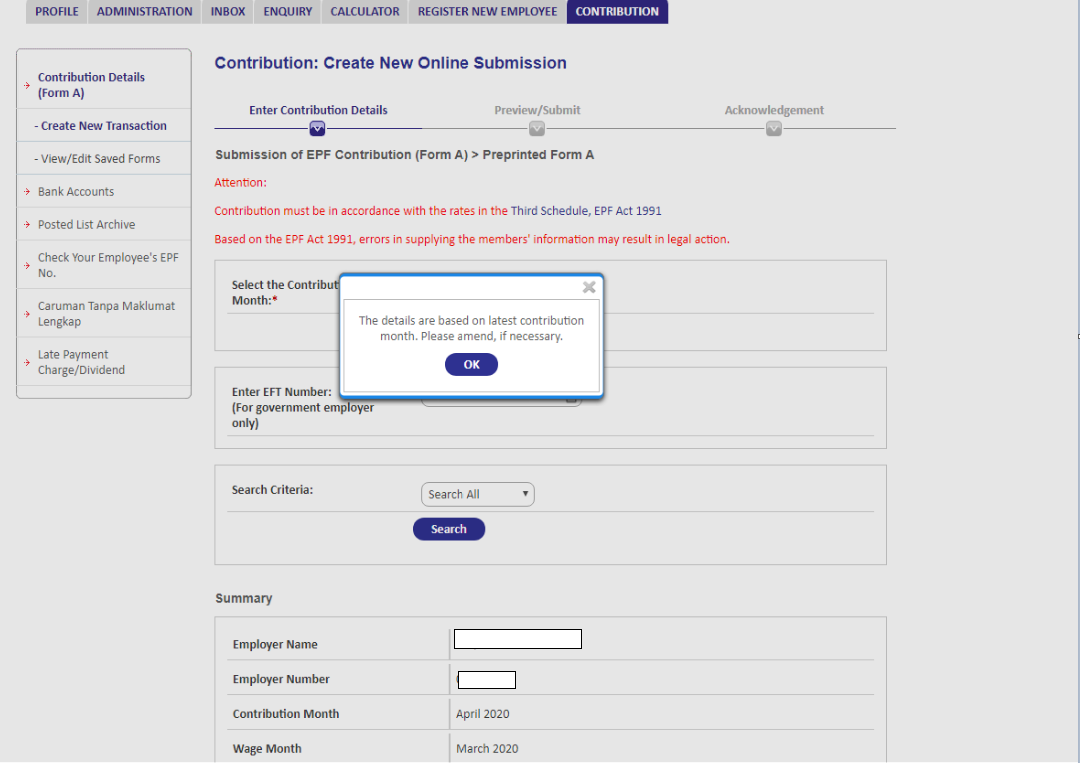

Preprinted Form A:

You can use the latest Form A that you have submitted online before for the previous month's contribution payment. You can proceed with payment if there are no changes, or you can make the changes before you continue with submission and payment.

-

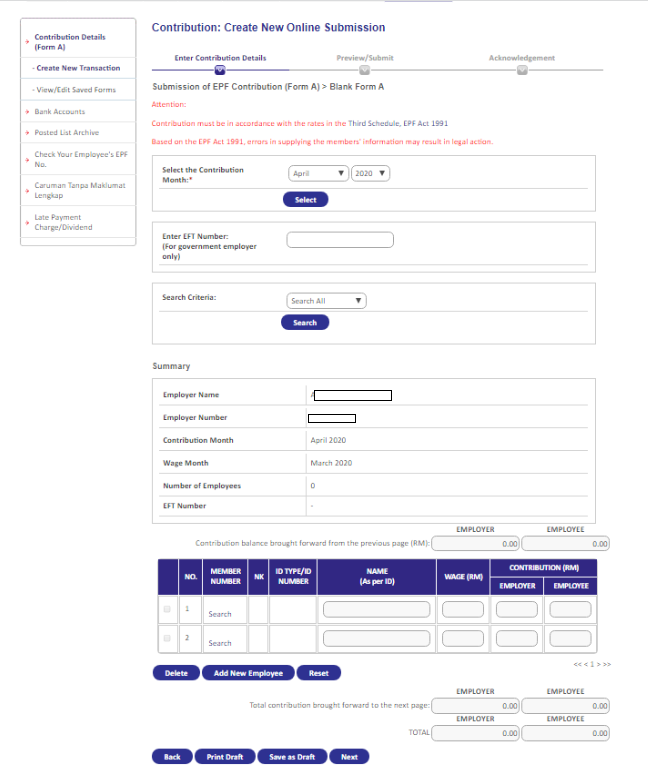

Blank Form A:

It is a blank form A which you are required to fill in with the contribution details of the employees.

-

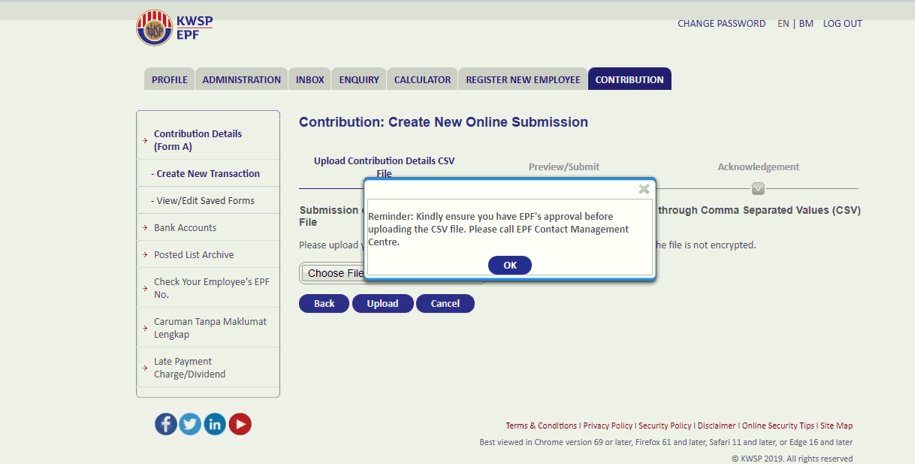

Upload Form A data by using Comma Separated Value (CSV) format:

If you are a PayrollPanda user, you can obtain the generated csv file upon payroll submission.

-

Upload Form A data by using CD/Diskette (EPFORMA.TXT/EPFORMA2.TXT) format:

Employers are required to prepare a CD/ Diskette with the contribution information.

For the contribution payment via e-Caruman, you can select your preferred payment method from the 4 payment options:

- You can opt to pay directly via the bank website (currently only available for Maybank customers)

- You can make payment via FPX (non-approval flow).

- You can make payment via direct debit (only for employers who have registered DDA).

- You can make payment at EPF/Bank counters.

How to submit/pay EPF via online banking

For EPF contribution submission and payment via online banking, you can submit the EPF payment bank file generated by PayrollPanda through your respective bank portal. The bank file contains the contribution details for each employee and separate submission via i-Akaun is therefore not required. At the moment bank files are only generated for the banks that are integrated with PayrollPanda which are Maybank, CIMB Bank, RHB Bank, Hong Leong Bank, Public Bank, OCB Bank, Alliance Bank and AmBank.

Please note that different banks have different types of files that can be uploaded in the bank portal. You may refer to the articles below to know more about how to make EPF payment for each bank.

Please read our article to know more about the EPF contribution rates.

Let our payroll software calculate all your contributions. Book a demo.