Every employer, as well as every company regardless of whether they have employees or not, must submit form E to LHDN. Failure to do so will result in LHDN taking action against the company’s directors.

Form E 2023 should be submitted by all companies and employers by 30 April 2024. The actual deadline is 31 March 2024 but you get a 1-month grace period for filing online. Online filing is the only option available this year so you have until 30 April to file.

For the filing to be complete, you must file both your E form and CP8D (statement of employees’ remuneration and deductions).

How to submit Form E via e-Filing?

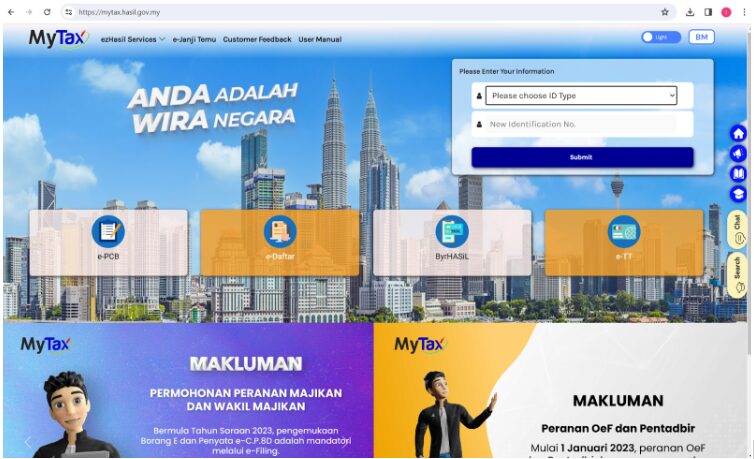

- Go to the MyTax portal.

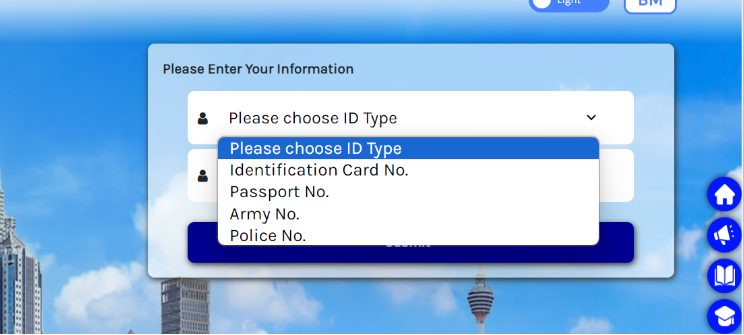

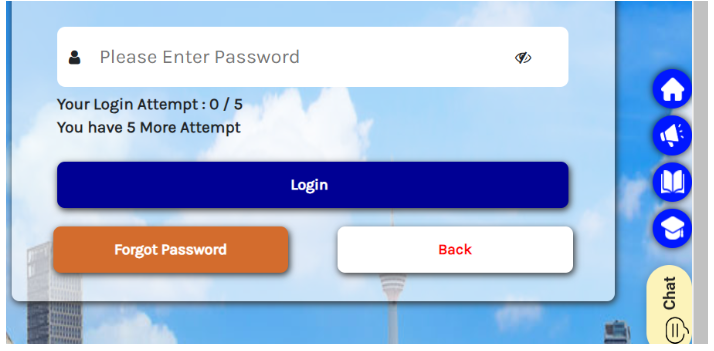

- Log in by selecting your ID Type and entering your ID number and password.

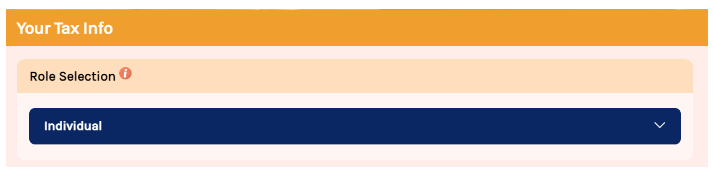

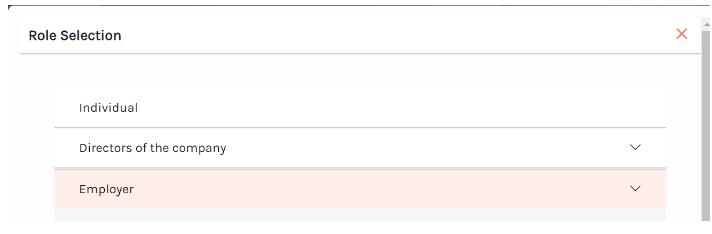

- Once logged in, click on the Role Selection dropdown menu and select Employer or Employer Representative, then click on the name of the business/company for which you want to submit the E form. If neither role appears, you can refer to this article to find out how to apply

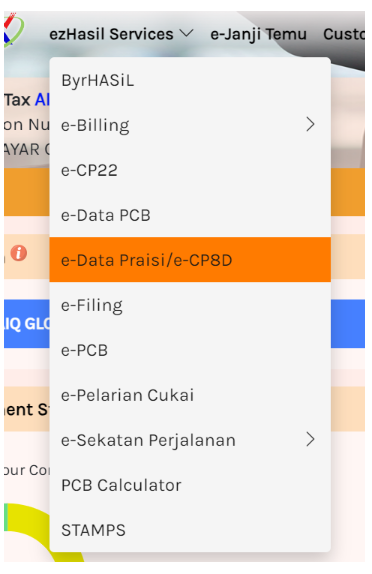

- Then, go to the EzHasil Services menu and select e-Data Praisi/e-CP8D to first submit your CP8D.Click on Submission of CP8D.

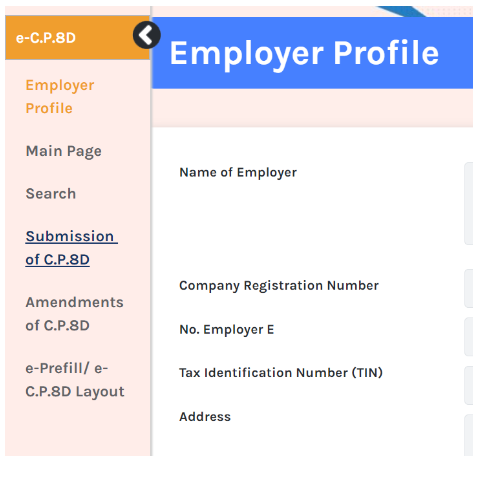

- Click on Submission of CP8D.

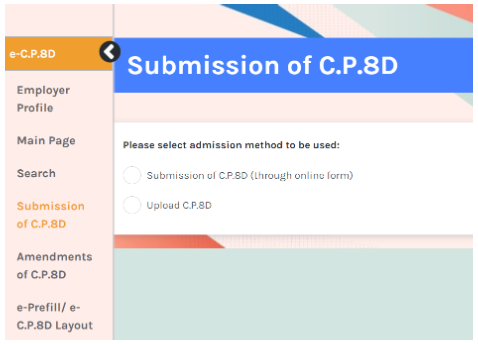

- You have the option to fill in the employees’ details via the online form or you can simply upload the CP8D txt file generated by PayrollPanda.

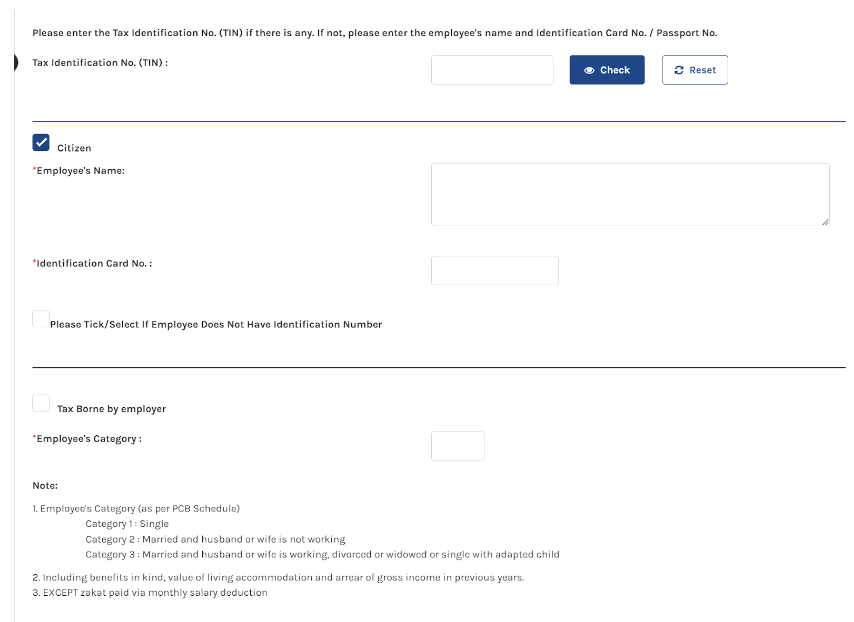

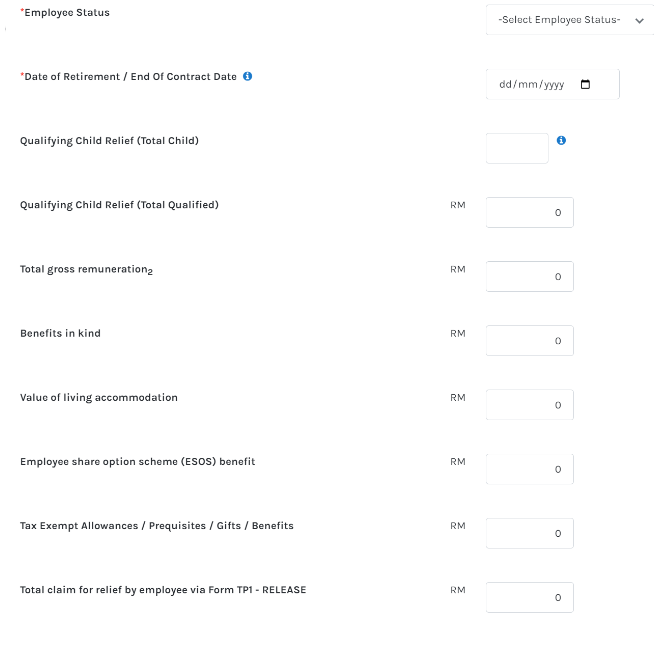

- If you select Submission of CP8D (through online form), you will need to fill in all your employees’ personal and remuneration details as shown below.

- If you select Upload CP8D, you will be able to upload the CP8D txt file generated by PayrollPanda. As the txt file contains all your employees’ required personal and remuneration details, you will not have to enter them one-by-one via the online form.

- Once uploaded, your employees’ remuneration details will be displayed so you can check if they are correct.

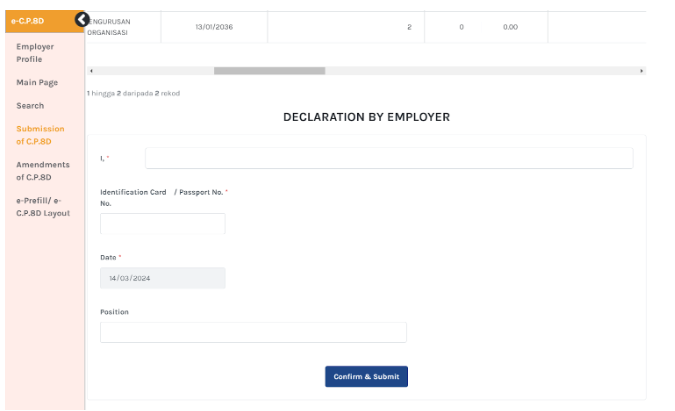

- Once you have checked the details, you can click on Confirm & Submit.

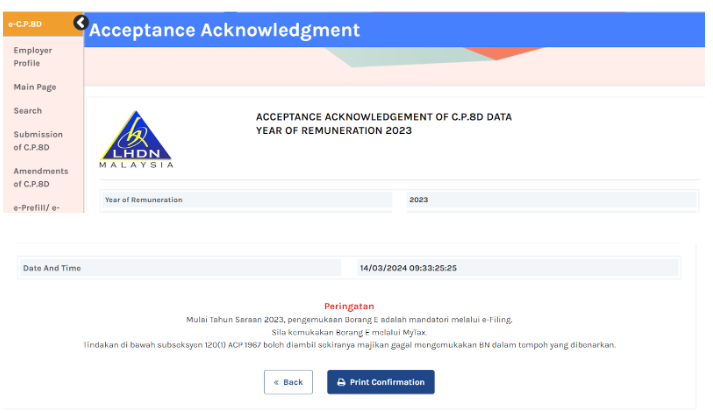

- You should then receive acknowledgement of the submission of your CP8D, which you can print or download by clicking on Print Confirmation.

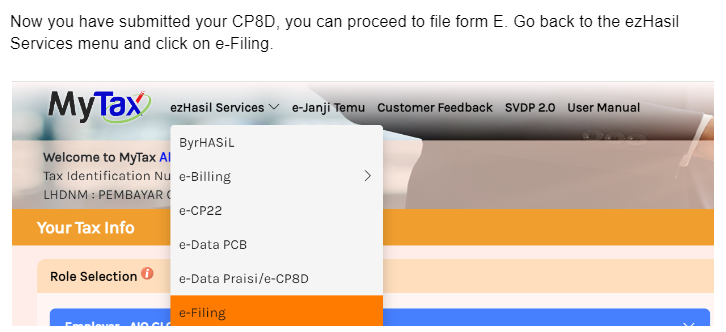

- Now you have submitted your CP8D, you can proceed to file form E. Go back to the ezHasil Services menu and click on e-Filing.

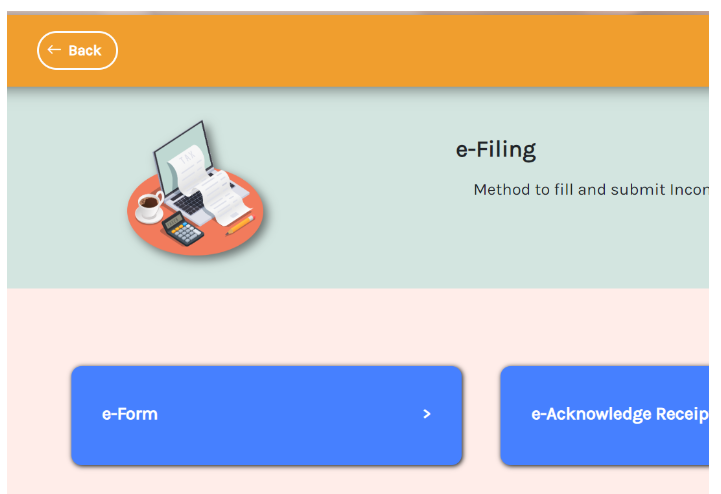

- Click on e-Form.

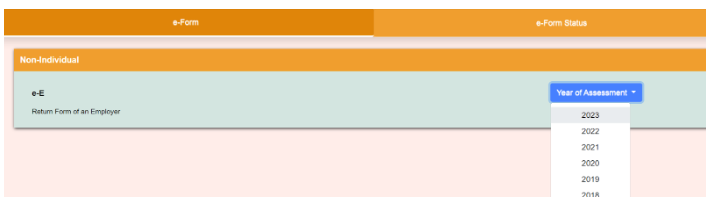

- Select the 2023 year of assessment.

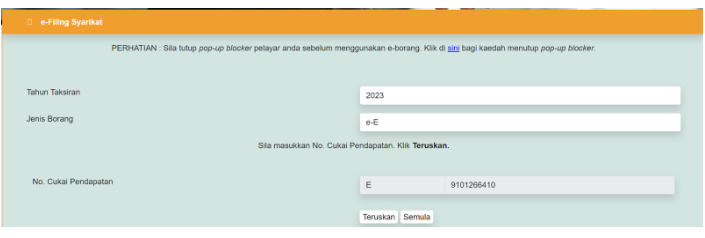

- Click on Teruskan.

- The form switches to BM, but you can switch back to English if preferred by clicking on EN at the top right of the page.

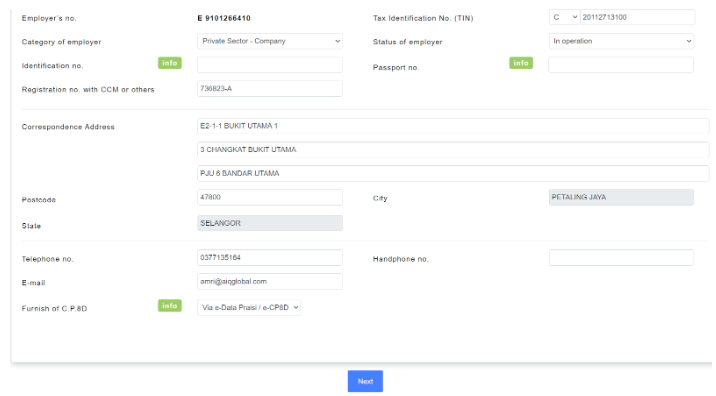

- Fill in any missing company details and click on Next.

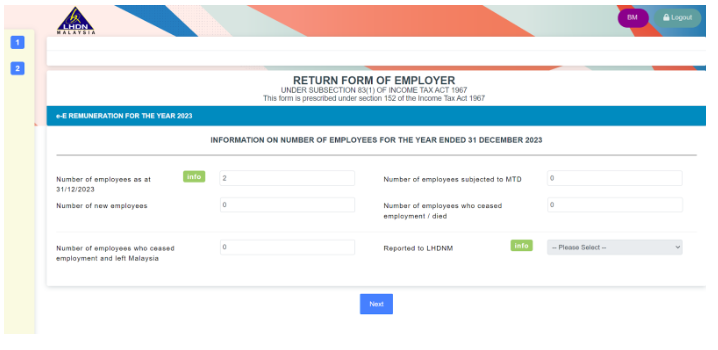

- Enter details of the number of employees at the year end and other numbers like new employees or employees who have left during the year, as well as number of employees subject to PCB. You can refer to the E form pdf generated by PayrollPanda to fill in those numbers since they have been automatically compiled for you.

- Click on Next.

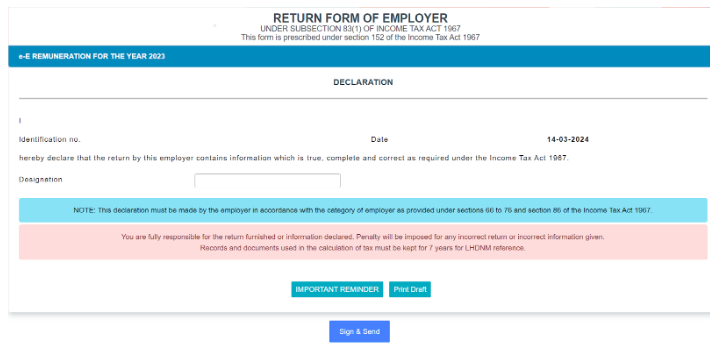

- Finally enter your designation and click on Sign & Send.

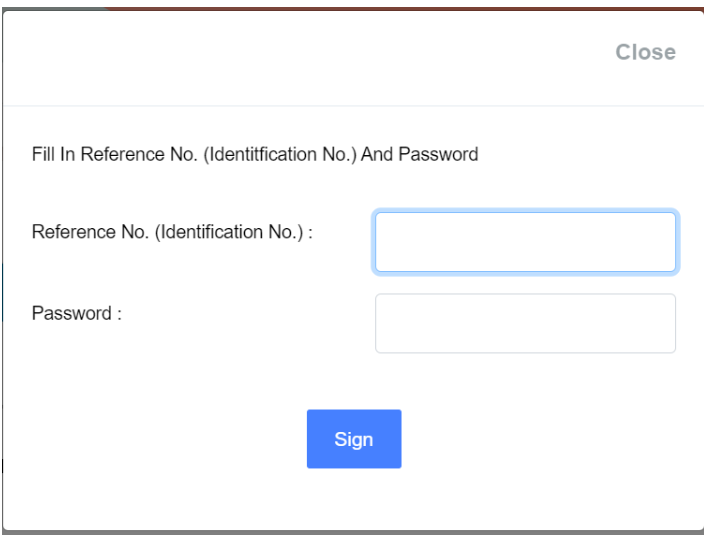

- To sign, enter your ID number and MyTax password.

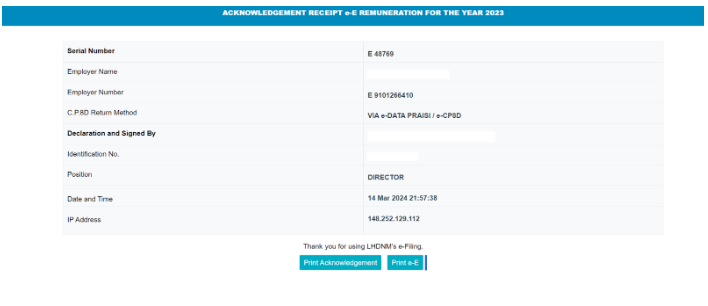

- You will receive acknowledgement of your Form e submission and you can download both the acknowledgement and the e-E.

Struggling with payroll? Let us help. Book a demo.