Did you know that the theme for Budget 2020 is "Driving Growth & Equitable Outcomes Towards Shared Prosperity"?

Let's see what new initiatives the government would introduce or extend especially in the areas of payroll.

📋 We’ve rounded up the key highlights for you:

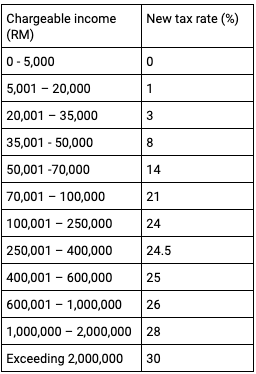

1. Income tax rates review

- It is proposed that a new band for chargeable income in excess of RM2,000,000 be introduced and taxed at 30%. The table below illustrates:

2. Expansion of the income tax relief scope for medical expenses

- Resident individuals get income tax relief of up to RM6,000 on medical expenses for serious diseases regarding self, spouse and child.

- This tax relief will also be expanded to include expenses incurred on fertility treatment.

3. Increase in the limit of tax relief for fees paid to childcare centres and kindergartens

- Income tax relief of up to RM1,000 is currently given to resident individuals on the amount of fees paid to a childcare centre or kindergarten for children up to 6 years old.

- It is proposed that the tax relief be increased from RM1,000 to 2,000 per year.

4. Income tax exemption for another 4 years for women returning to work after a career break

- The current income tax exemption for women returning to work after a career break will be extended for another 4 years until 2023.

- These women who return to the workforce will receive a wage incentive of RM500 per month for 2 years.

Besides taxes and payroll, levelling up human capital is also one of the key highlights in Malaysia's recent Budget 2020. The Government will review the Employment Act 1955.

📋 Here is what they also proposed:

1. Increase of minimum wage

- Raising the minimum wage to RM1,200 per month for major cities.

2. Maternity Leave

- Increasing maternity leave from 60 days to 90 days effective 2021.

3. Overtime

- Extending eligibility to overtime from those earning less than RM2,000 to those earning less than RM4,000 per month.

4. Sexual Harassment Protocol

- Improving protection and procedures for handling sexual harassment complaints.

5. Provisions on Discrimination

- Introducing new provisions on the prohibition of discrimination based on religion, ethnicity, and gender.

For the full Malaysia Budget 2020 speech, click here. |