The HRDF levy is a levy payment collected for the purpose of employee training and skills upgrading. From 1 March 2021, access to HRDF was expanded to all industries. Firms with 10 or more local employees are obligated to register, while firms with 5 to 9 local employees have the option to register.

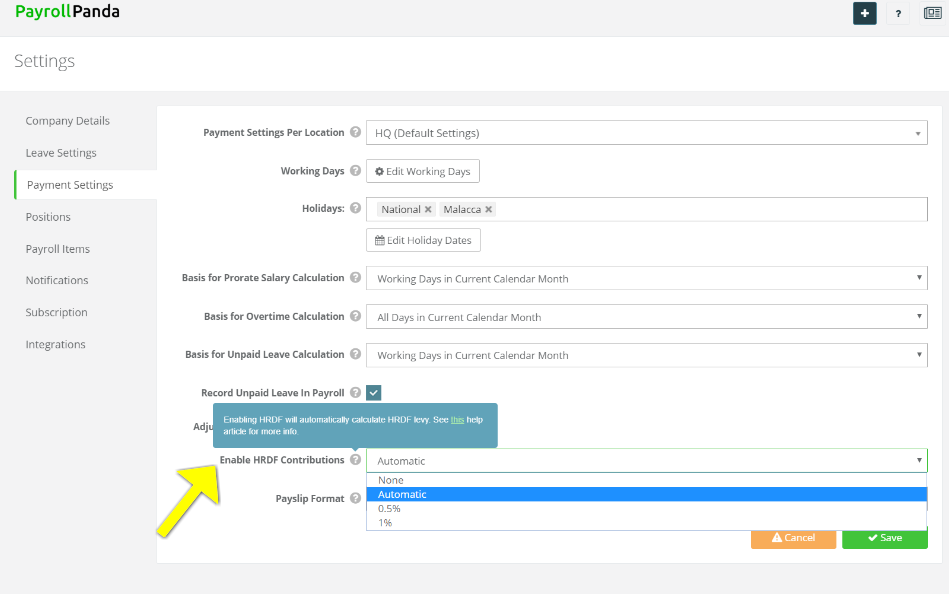

HRDF contributions are disabled by default. The setting can be modified as follows:

- Go to Settings

- Choose Payment Settings

- Select one of the available options for HRDF contributions.

Four types of options are available for you to choose from the drop-down menu: None, Automatic, 0.5% and 1%.

If HRDF is set as Automatic, the system will calculate the contribution based on the following rates:

- 5 to 9 full-time Malaysian employees (whether permanent, contract or temporary): HRDF contribution of 0.5%

- 10 or more full-time Malaysian employees (whether permanent, contract or temporary): HRDF contribution of 1%

The wages of part-time employees, interns and non-Malaysian employees are not included in the levy calculation.

The levy rate for employers registered under the compulsory category should be maintained at 1% even if the employee count falls to below 10. They can apply for deregistration if they employ less than 10 Malaysian workers for 3 consecutive months. If you registered under the optional category, once you reach 10 Malaysian employees you must continue contributing at 1% for the whole calendar year even if your headcount falls to fewer than 10 employees again during the year.

The HRDF contribution is calculated based on basic salary plus any fixed allowances, except travel allowance. In PayrollPanda, any allowances added as monthly recurring in the employee's profile will be added to the salary subject to HRDF, except:

- Travel/Petrol Allowance (Official Duties)

- Travel/Petrol Allowance (Records Kept For 7 Years)

- Parking Allowance

- Internship Allowance

If a custom payroll item is created under the Allowance category and added to the employee's profile as a recurring payroll item, it will also be included in the calculation. If you have monthly recurring allowances which are not fixed and you do not want them included in the HRDF calculation, you should create a custom payroll item under the Other Perquisites category instead of the Allowance category. For more information regarding monthly recurring payroll items, please read How to add payroll items and the difference between recurring and one-off payments?

Take note that the following payroll items will affect the HRDF calculation:

- Leave Pay, Advance Payment, Arrears of Salary & Arrears of Wages

- Unpaid Leave

- Advance (Payment Made via payroll) & Salary Adjustment

If you prefer to add your own HRDF amount for each employee, you can use our preset payroll deduction Employer HRDF Levy (Custom).

Example of HRDF levy calculation:

If you are contributing 1% and your employee earns RM3,000 plus a fixed allowance of RM250, the calculation for the HRDF levy is as follows:

(RM3,000 + RM250) * 1% = RM32.50

That’s all for now! Check out other related articles below. If you need help, contact our support team!