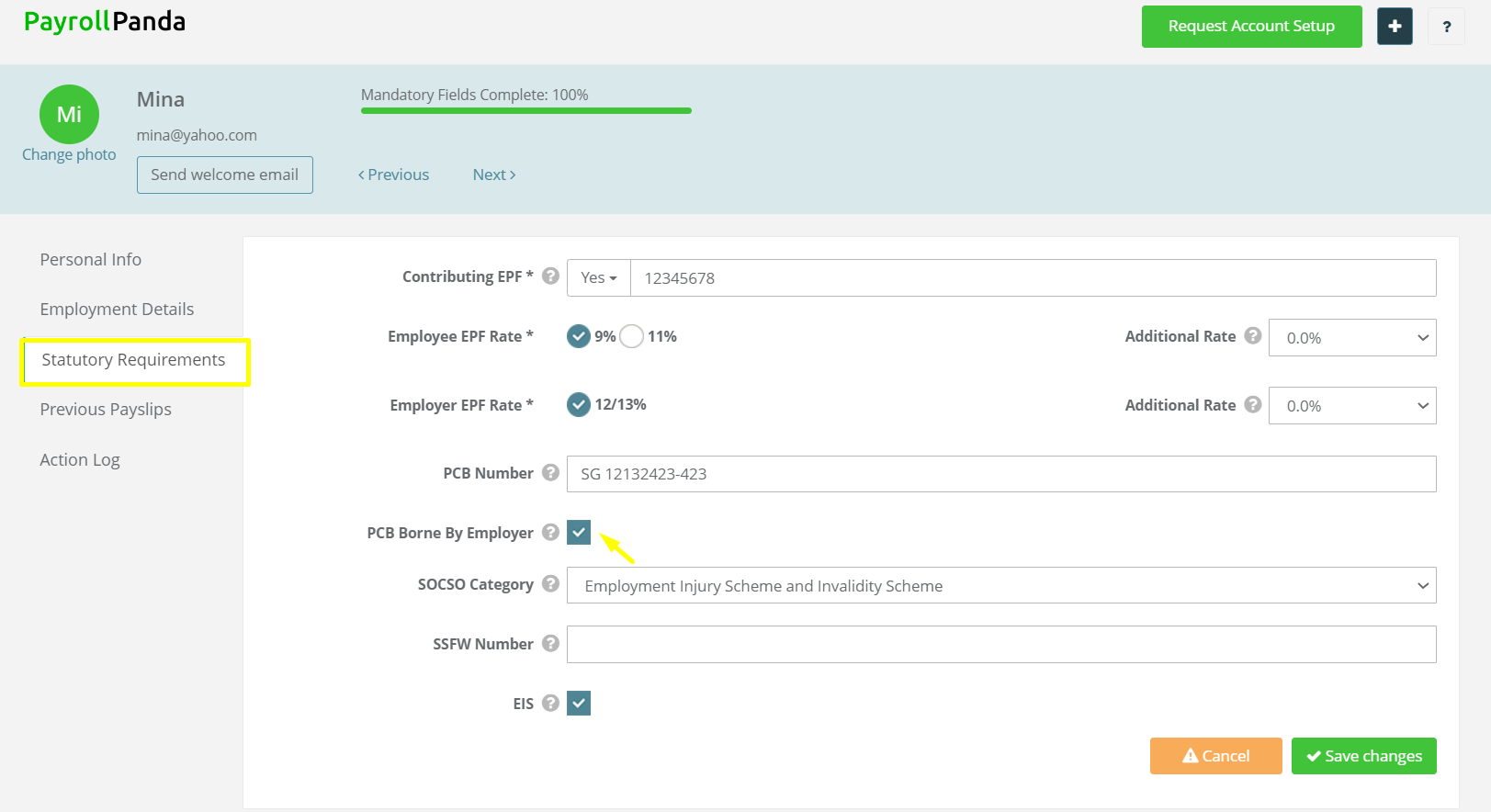

"PCB borne by employer" should be ticked when the employer is bearing the PCB expense for the employee instead of deducting the PCB from the employee's salary. When "PCB borne by the employer" is ticked, PCB will be calculated but not deducted from the employee's gross pay.

PCB borne by the employer is a taxable perquisite to the employee and the total perquisite is added to the taxable income of the employee for PCB calculation purposes in the following tax year.

If you need more information or you are looking for a payroll solution, contact us via the chat support at the bottom of this page.

This help article was compiled for version 0.29.1 of app.payrollpanda.my