1. Monthly Recurring Payroll Items

Monthly Recurring payroll items are items like allowances, commission or overtime that are paid on a monthly basis. Once you've added the salary or wage you can add these ongoing recurring payroll items. Having these items set up under recurring is important to ensure accurate PCB calculations! Please refer to this article to find out when should we select certain payroll items as recurring?

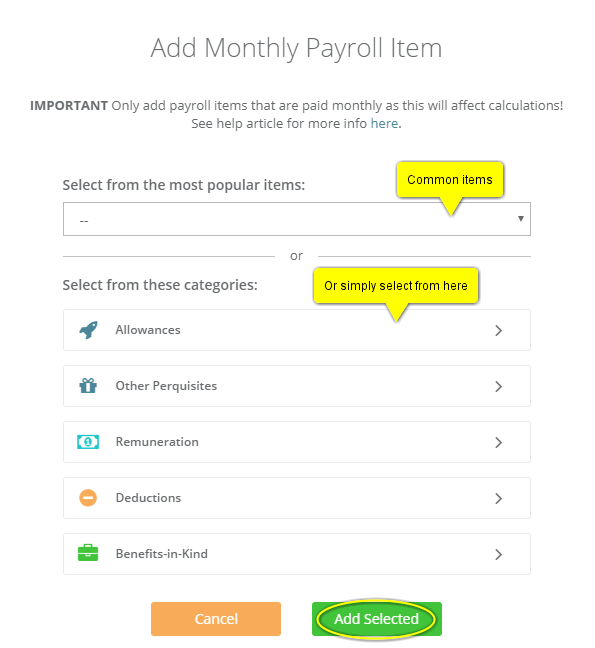

a. Go to Add Recurring Payroll Items under Employment Details for each employee.

Employees > ‘Select Employee’ > Employment Details > + Monthly Recurring Payroll Items

b. Choose the payroll item from the most popular items or from one of the categories and click Add Selected.

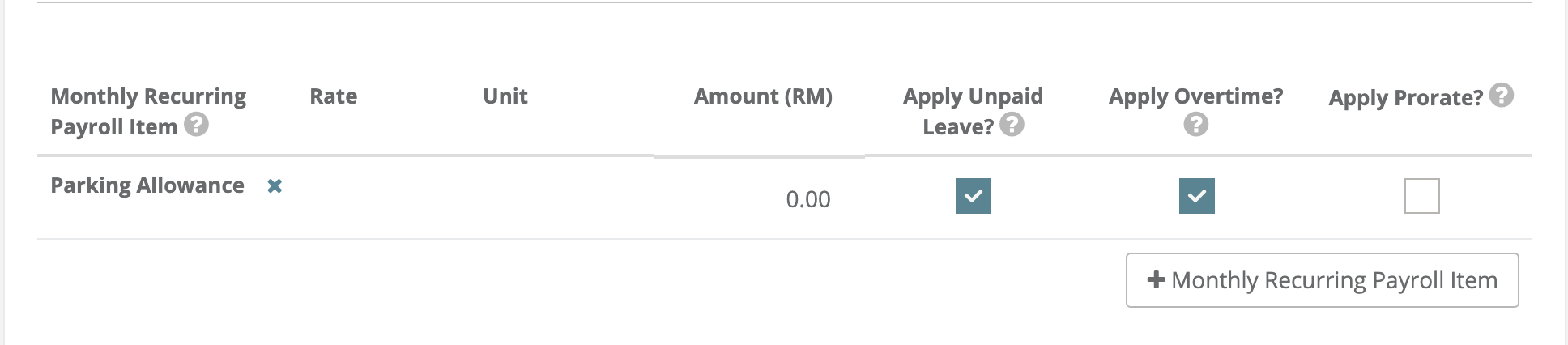

c. Enter the amount for the payroll item. You can choose whether the item should be taken into account in Unpaid Leave or Overtime calculations, and whether to prorate the item according to join/leave date, by ticking the relevant boxes. You can add a fixed amount or leave the amount as 0 if the amount varies from month to month (you will be able to enter the monthly amount at step 1 when running your monthly payroll). Click Save Changes at the bottom of the page when you are done.

2. Additional Payroll Items

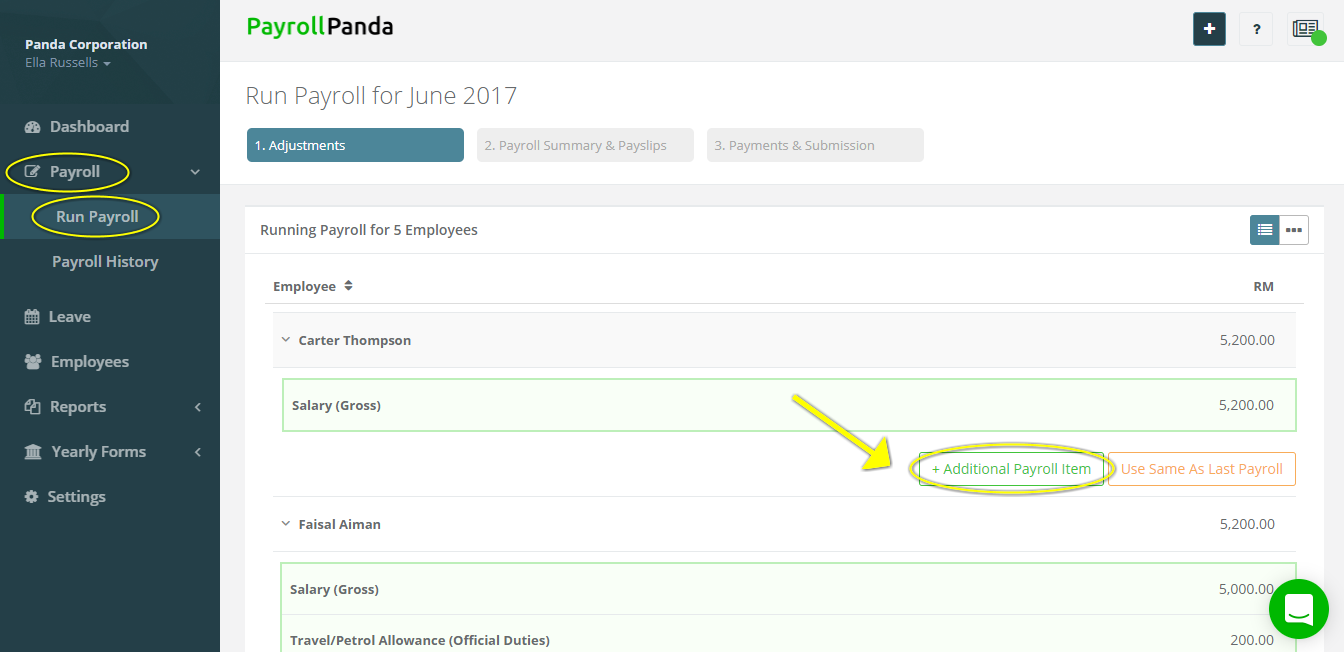

If you want to add payroll items that are not paid on a monthly basis but as one-off additions, then you should add them at Step 1 of Run Payroll (Adjustments).

a. After you click on Run Payroll, choose + Additional Payroll Item for the selected employee.

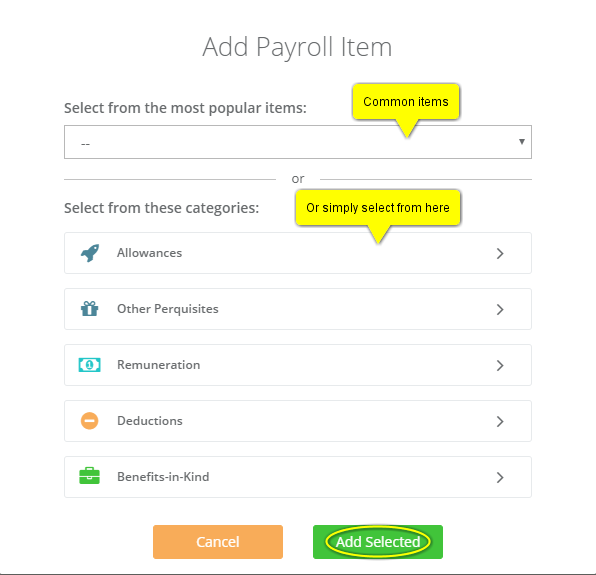

b. Choose the payroll item and click Add Selected.

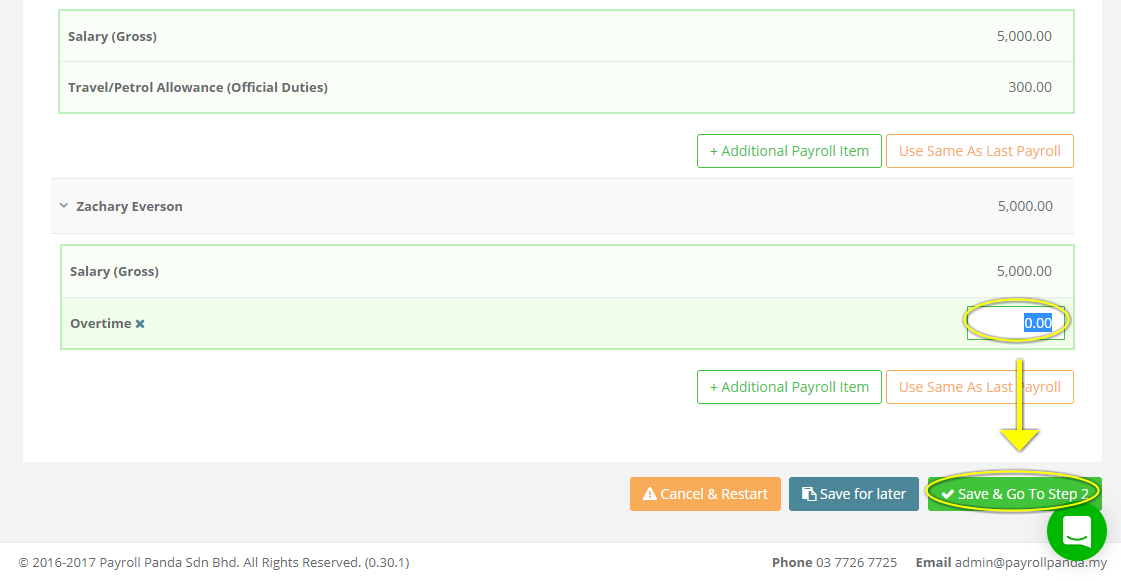

c. Enter the desired amount, scroll to the bottom and click Save & Go To Step 2. Alternatively, you can choose Save for later.

This help article was compiled for version 0.30.1 of app.payrollpanda.my